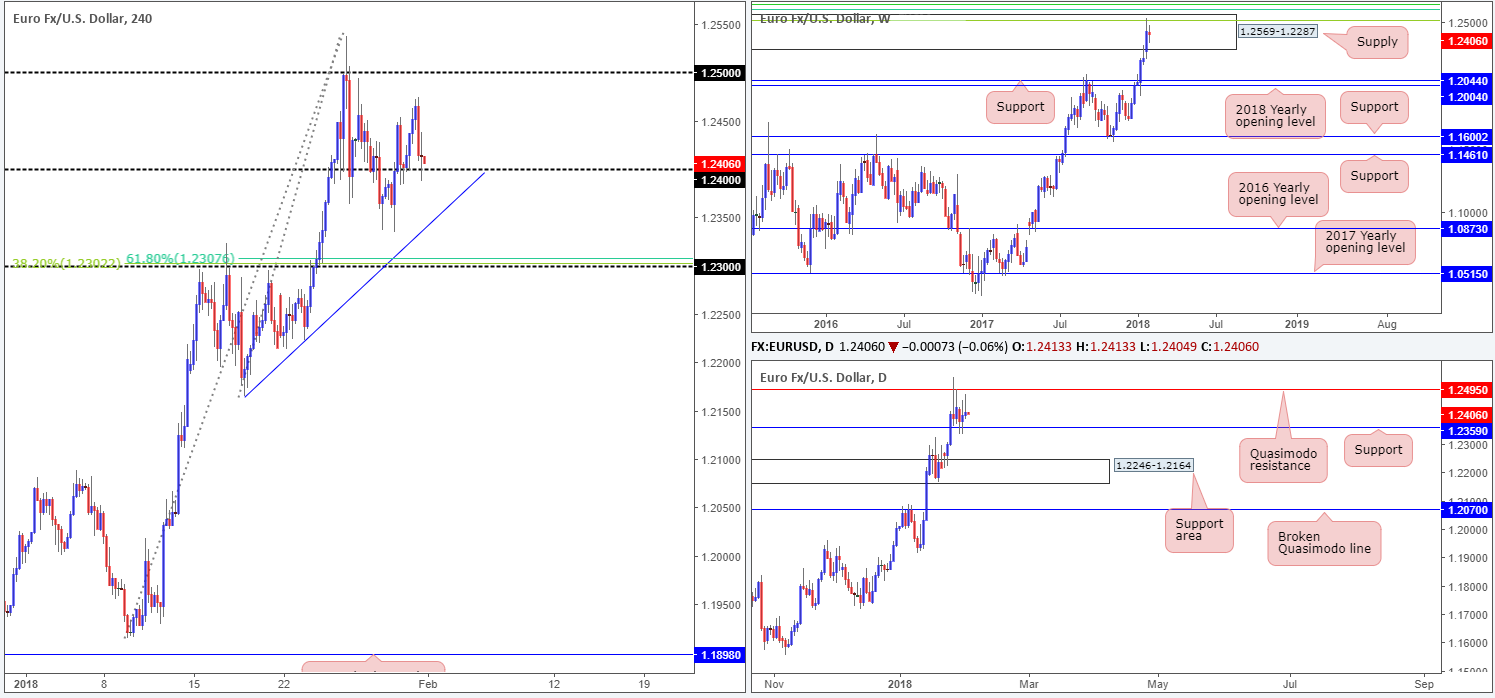

EUR/USD: The US Federal Reserve kept interest rates unchanged on Wednesday, as expected. The Fed, which hiked interest rates three times last year, mentioned the economy warranted ‘further gradual’ increases in rates. The target range for the federal funds rate currently is 1.25%-1.50%. The impact of the Fed’s decision/statement was somewhat muted on the … Continue reading Thursday 1st February: Technical outlook and review.

Category: Uncategorized

Wednesday 31st January: European Open Briefing

Global Markets: Asian stock markets: Nikkei down 0.62%, Shanghai Composite down 0.59%, Hang Seng down 0.12%, ASX up 0.25% Commodities: Gold at $1342.00 (+0.49%), Silver at $17.17 (+0.66%), WTI Oil at $63.91 (-0.91 %), Brent Oil at $67.98 (-0.79%) Rates: US 10-year yield at 2.707, UK 10-year yield at 1.462, German 10-year yield at 0.691 … Continue reading Wednesday 31st January: European Open Briefing

Wednesday 31st January: FOMC meeting today – remain vigilant!

EUR/USD: In recent sessions, the single currency chalked up a H4 double-bottom formation around the daily support level positioned at 1.2359, and gravitated beyond the 1.24 handle to a session high of 1.2453. Belter-than-expected US consumer confidence then pulled the H4 candles back down to the 1.24 region, where price formed support going into … Continue reading Wednesday 31st January: FOMC meeting today – remain vigilant!