EUR/USD: In early London hours, Tuesday’s action crossed swords with intraday resistance on the H4 timeframe at 1.2336 and staged a somewhat dominant selloff. Likely influenced by a mixture of softer Eurozone PMIs, lackluster German retail sales and a stronger greenback, the move cleared H4 support at 1.2285 and ended the day shaking hands … Continue reading Wednesday 4th April: US ADP non-farm employment change eyed (considered a forerunner to Friday’s main US employment report).

Category: Uncategorized

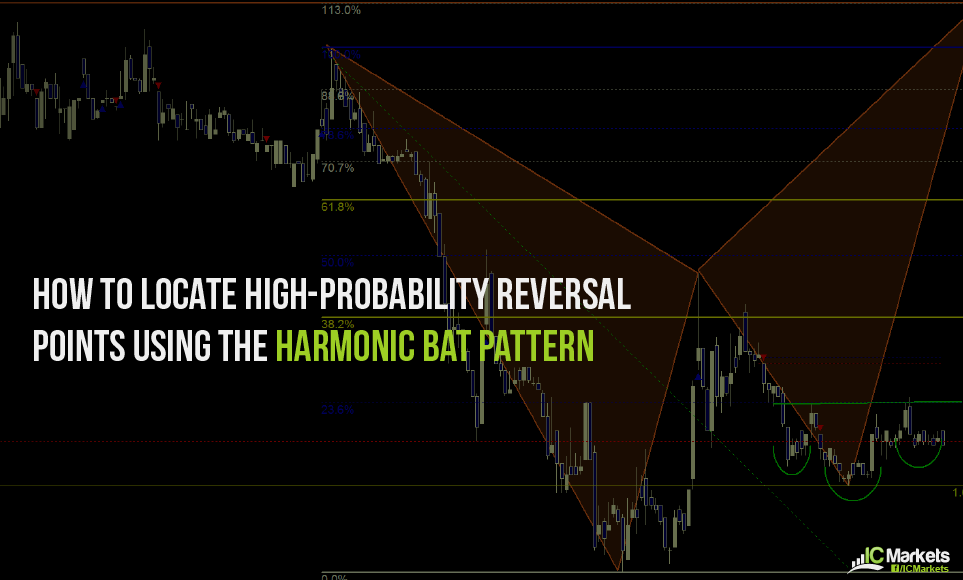

Locate High-Probability Reversals Using the Harmonic Bat Pattern

Developed by Scott Carney, the harmonic bat pattern, a variation of the Gartley harmonic pattern, is a 5-point retracement structure composed of Fibonacci measurements used to create a potential reversal zone, or PRZ.

Trading the Gartley Harmonic Pattern

Updated August 2020 While some disregard harmonic trading, others are incapable of operating without it. The Gartley pattern, sometimes referred to as a Gartley 222, was introduced by H.M. Gartley in his book Profits in the Stock Market[1], in 1935. Nowadays, however, many traders follow the teachings of Scott M. Carney. In his book, The … Continue reading Trading the Gartley Harmonic Pattern

Tuesday 3rd April: Asian markets in the red after US tech selloff

Global Markets: Asian Stock Markets : Nikkei down 0.34%, Shanghai Composite down 1.25%, Hang Seng down 0.59%, ASX down 0.13% Commodities : Gold at $1343.50 (-0.25%), Silver at $16.55 (-0.76%), WTI Oil at $67.72 (+0.12%), Brent Oil at $63.06 (+0.08%) Rates : US 10-year yield at 2.741, UK 10-year yield at 1.343, Germany 10-year yield … Continue reading Tuesday 3rd April: Asian markets in the red after US tech selloff